ABOUT FUTURA

Redefining Financial Access for the Modern Retail World

Futura is redefining financial convenience by combining trusted retail environments, innovative technology, and proven execution. We transform everyday retail locations into smart, self-service financial hubs that give customers faster, easier, and more secure access to essential financial services.

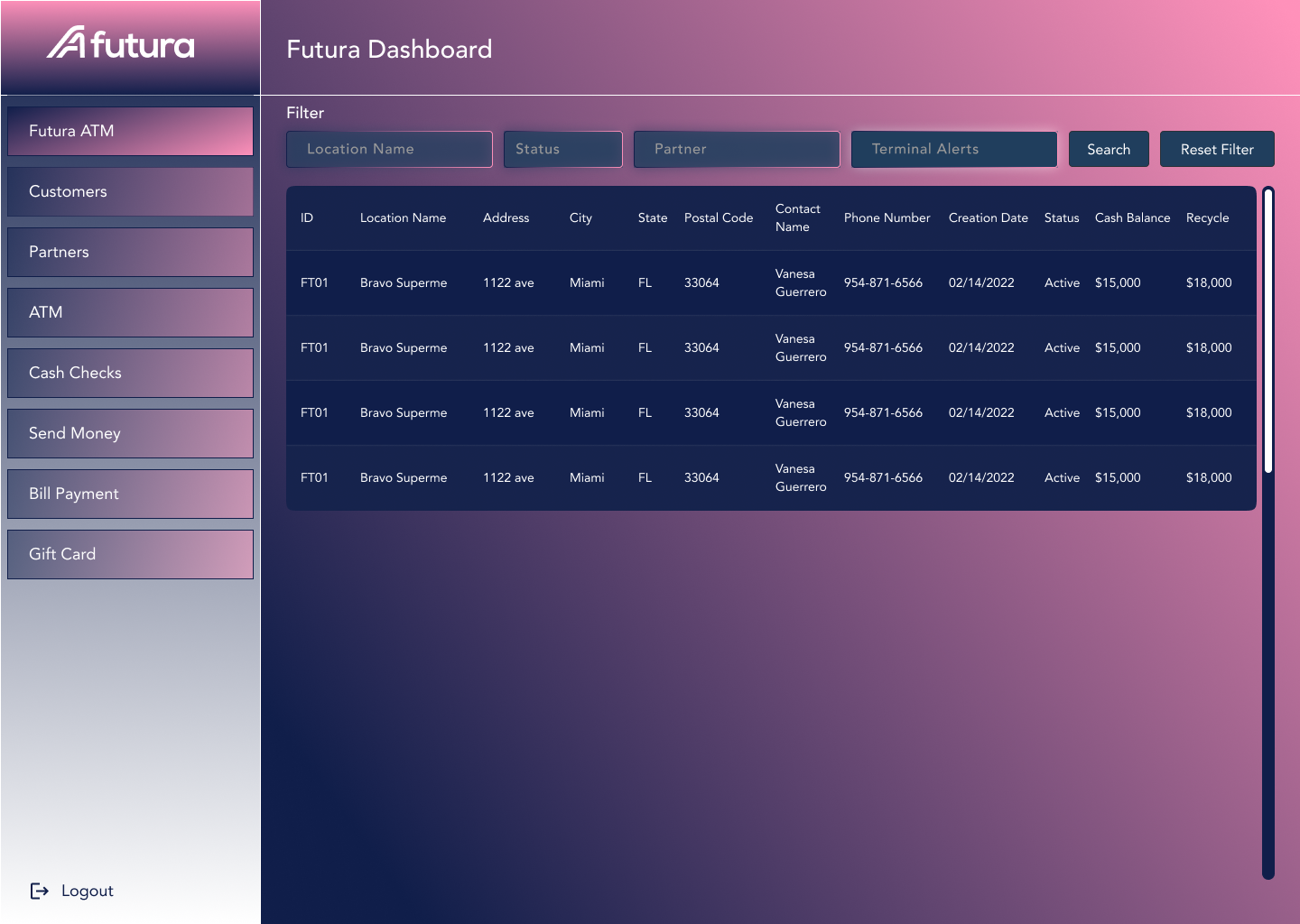

SOFTWARE

Futura is a financial software company that converts any retail location into a smart, self-service financial hub.

INTEGRATION

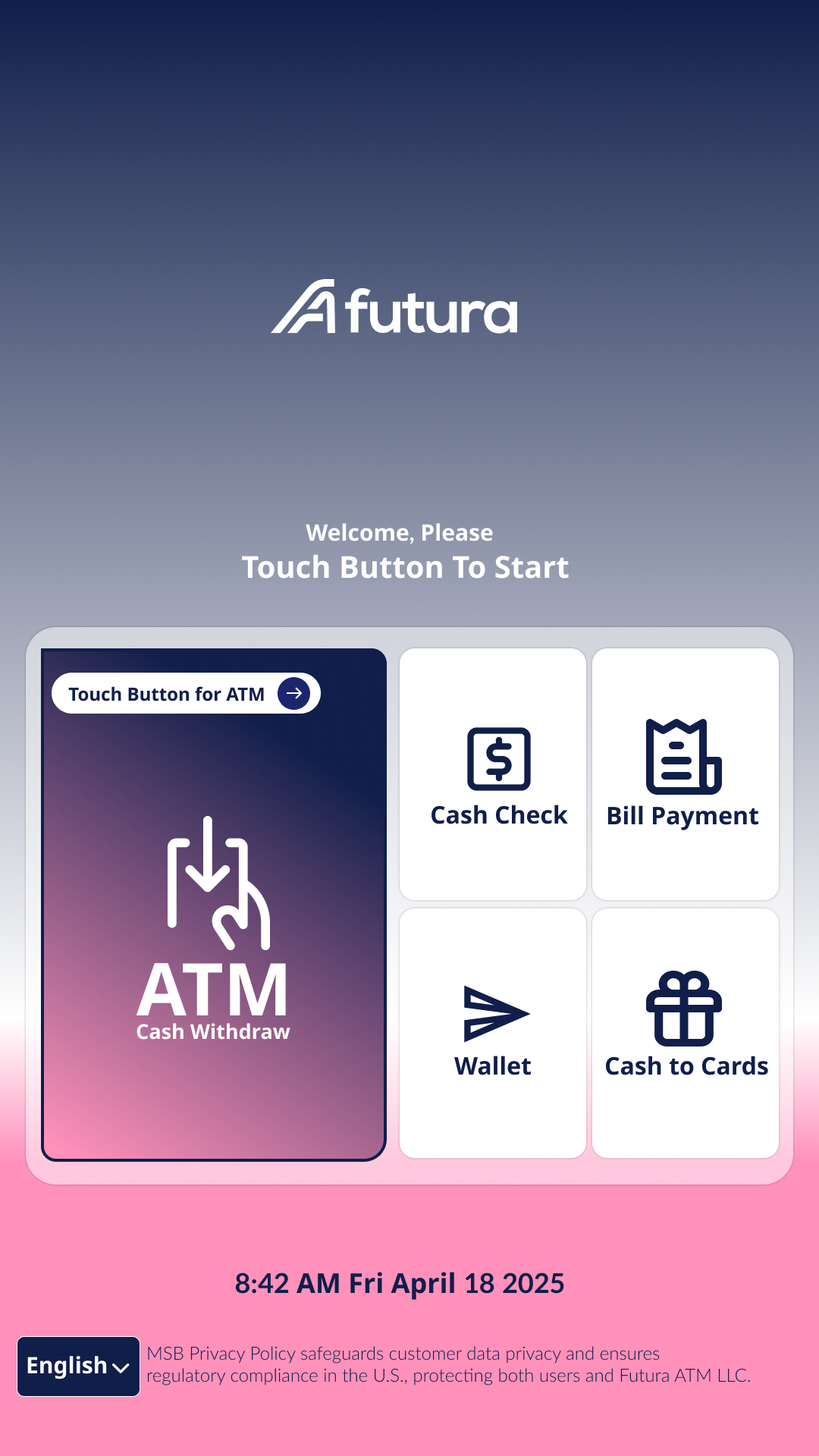

Our platform integrates ATMs, kiosks, Smart Bank Tellers, and payment APIs to deliver secure, compliant and frictionless financial services for consumers—directly at the point of sale.

Corporate finance

We support banks, credit unions, fintechs, and payment processors by extending their digital reach through automated retail environments.

OUR SOLUTIONS

HOW FUTURA WORKS

Step 1 — Deployment

We install Smart Bank Tellers or ATMs in retail locations with high customer traffic

Step 2 — Integration

Our platform connects to partner banks, payment processors, remittance providers, and compliance systems through secure APIs.

Step 3 — Activation & Revenue

Partners and retailers earn from every transaction, while customers enjoy instant, easy access to financial services.

INDUSTRIES WE SUPPORT

Banks & Credit Unions

Payment Processors

Retail Chains (High Traffic)

Supermarkets & Grocery Stores

Gas Stations & C-Stores

ATM Operators

Fintech Platforms

ISO/MSO Networks

best experts on the market

Our team is your solution

Lorem ipsum dolor sit amet, at mei dolore tritani repudiandae. In his nemore temporibus consequuntur, vim ad prima vivendum consetetur. Viderer feugiat at pro, mea aperiam.

CEO – FOUNDER

Alejandro Rodriguez

He leads the company’s vision to expand financial access through secure, automated retail technology.

With deep experience in payments and fintech, he builds compliance-aligned solutions for institutional partners.

Under his leadership, Futura operates as a trusted technology and distribution channel for licensed financial entities.

COO – Founder

Vanessa k Guerrero

She oversees operational strategy, partner integration, and the execution of Futura’s technology across retail environments.

With strong experience in payments, compliance workflows, and retail operations, Vanessa ensures seamless coordination between partners, teams, and deployments.

Her leadership drives efficiency, reliability, and scalable growth throughout the Futura ecosystem.

F.A.Q.

Frequently Asked Questions

No. Futura is not a bank, MSB, money transmitter, or payment institution.

We are a technology provider and retail distribution channel.

All regulated financial services are delivered through the licenses of our banking and payment partners.

The licensed partner is responsible for: compliance decisions, KYC/KYB approval, customer onboarding, AML monitoring, regulatory reporting, and funds settlement. Futura supports by capturing data securely, but does not make compliance decisions.

No.

Futura never touches or controls funds.

All money movement happens directly between the customer and the licensed financial partner.

Futura operates under the licenses of our third-party partners, such as: banks, remittance companies, ATM processors, payment platforms

Futura supplies the technology and the retail channel.

The partner supplies the licenses and regulatory framework.

Whether you’re a bank, payment processor, fintech, or retail operator, Futura is here to help you expand your services safely, efficiently, and without additional regulatory complexity.

We work alongside licensed financial partners to deliver secure, automated financial services inside high-traffic retail environments—powered by your licenses and our technology.