Why Banks Need Futura

Financial institutions face mounting challenges in capturing and managing cash flows

Loss of deposits, liquidity, and valuable financial data — weakening competitive positioning in the evolving financial landscape.

Cost-effective Solutions

Our smart bank teller simplifies cash handling and reduces costs.

Improved Access and Reach

Our smart bank teller serves as a convenient way to access cash and reach more locations.

Increased Merchant Coverage

Our smart bank teller makes it easier for banks to collaborate with cash-intensive merchants.

Efficient Financial Management

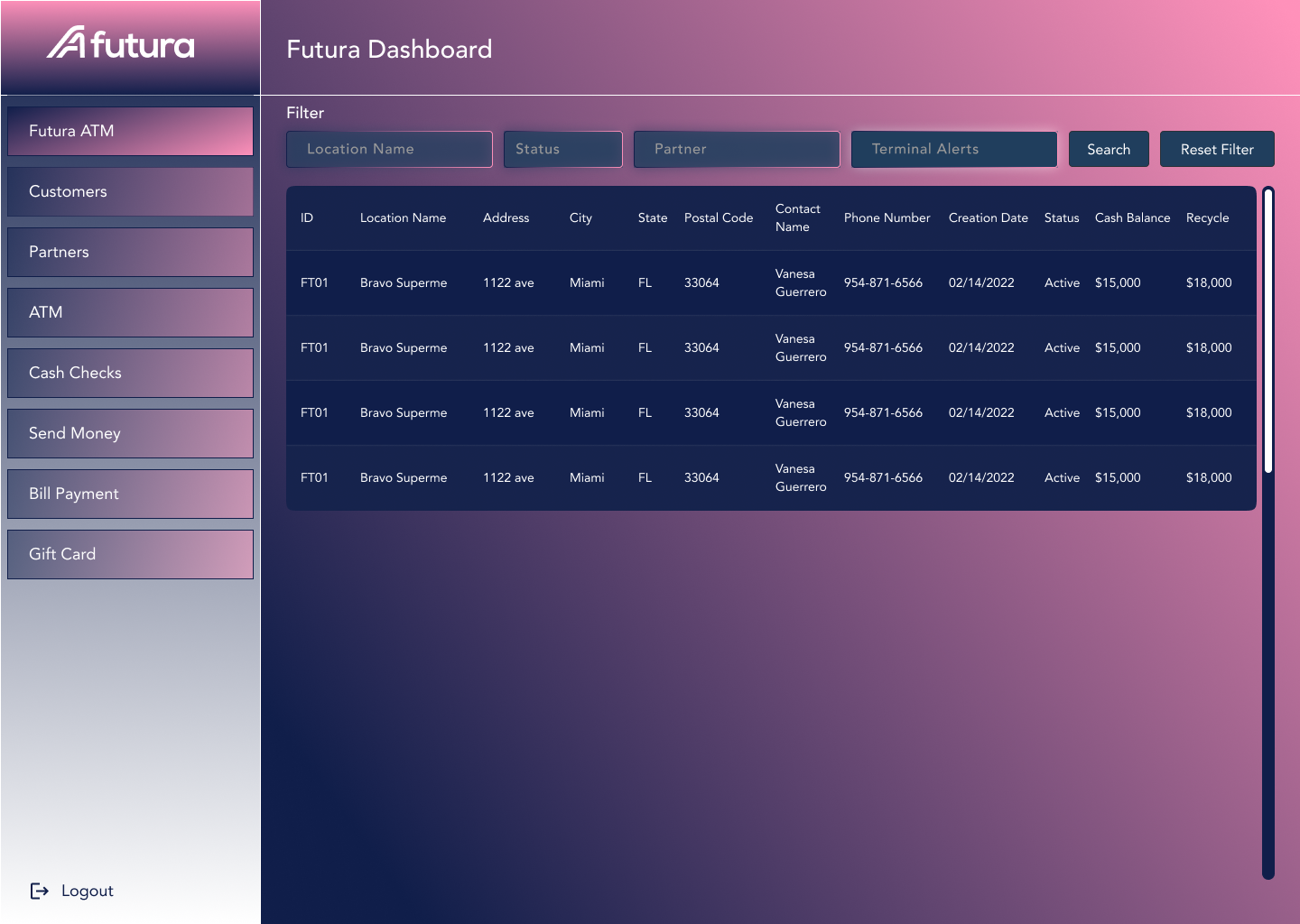

Our smart bank teller offers transaction-level visibility to manage financial data efficiently.

About

Certified Financial Infrastructure

for Banks and Merchants

“futura converts physical cash into bankable, traceable, and compliant transactions using certified hardware and proprietary software, helping financial institutions capture liquidity, increase regulated transaction volume, and access structured financial data!”

SOFTWARE

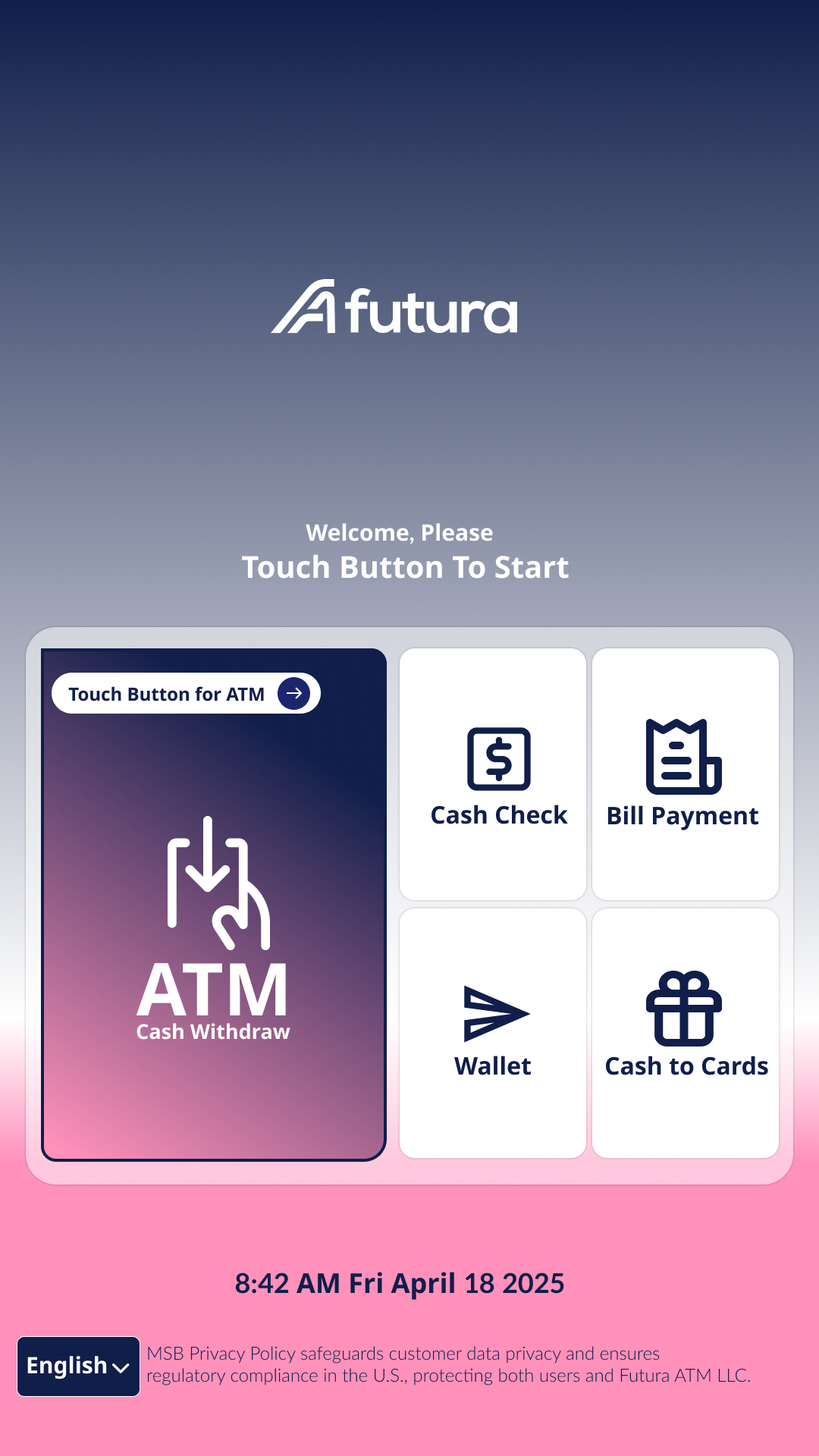

Futura is a financial software company that converts any retail location into a smart, self-service financial hub.

INTEGRATION

Our platform integrates ATMs, kiosks, Smart Bank Tellers, and payment APIs to deliver secure, compliant and frictionless financial services for consumers—directly at the point of sale.

Corporate finance

We support banks, credit unions, fintechs, and payment processors by extending their digital reach through automated retail environments.

Operations, Technology, and

Compliance Integrated

Futura’s Role

- Daily operations and logistics

- Maintenance and support

- First-line operational controls

Bank’s Role

- Sponsorship and partnership

- Regulatory supervision

- Final compliance authority

Revenue Model

Bullets

Revenue Model

Our revenue model is based on transaction-based fees, revenue sharing with financial institutions, and monthly infrastructure/location fees.

Transaction-based fees

We earn revenue by charging transaction-based fees for ATM usage.

Revenue sharing with financial institutions

We also partner with financial institutions to share revenue generated from ATM usage.

INFRASTRUCTURE

Scalable Infrastructure with Efficient Operations

Deployment Strategy

Cluster-based geographic rollout targeting high cash intensity locations: gas stations, convenience stores, and local merchants.

Scalability

Growth driven by infrastructure deployment rather than proportional increases in headcount.

HOW FUTURA WORKS

Step 1 — Deployment

We install Smart Bank Tellers or ATMs in retail locations with high customer traffic

Step 2 — Integration

Our platform connects to partner banks, payment processors, remittance providers, and compliance systems through secure APIs.

Step 3 — Activation & Revenue

Partners and retailers earn from every transaction, while customers enjoy instant, easy access to financial services.

Compliance & Risk Management

General Aspects

Our ATM manufacturing business is dedicated to upholding the highest standards of compliance and risk management. We understand the importance of providing secure and reliable products to our customers.

AML/KYC Embedded in Product Architecture

In order to ensure compliance with AML/KYC regulations, our product architecture is embedded with features such as commercial customer KYC, location due diligence, transaction monitoring, threshold alerts, and SAR support.

Documented Policies and Internal Audits

Our company has strict policies in place to ensure compliance and minimize risks.

Operational Risk Mitigation

We take every precaution to mitigate operational risks.

Regulatory Risk Mitigation

We maintain a conservative compliance posture and are adaptable to changes in regulations.

INDUSTRIES WE SUPPORT

Banks & Credit Unions

Payment Processors

Retail Chains (High Traffic)

Supermarkets & Grocery Stores

Gas Stations & C-Stores

ATM Operators

Fintech Platforms

ISO/MSO Networks

Our team

Futura ATM is led by an experienced executive team with deep expertise in financial infrastructure, operations, technology, and regulatory compliance.

CEO – FOUNDER

Alejandro Rodriguez

“He leads Futura’s vision to integrate the cash economy into the regulated financial system through secure, automated infrastructure, leveraging deep expertise in payments and fintech to deliver compliance-aligned solutions for institutional partners.”

COO – Founder

Vanessa k Guerrero

“She oversees operational strategy and partner integration, ensuring the seamless execution of Futura’s technology across retail environments through deep expertise in payments, compliance workflows, and scalable operations.”

F.A.Q.

Frequently Asked Questions

No. Futura is not a bank, MSB, money transmitter, or payment institution.

We are a technology provider and retail distribution channel.

All regulated financial services are delivered through the licenses of our banking and payment partners.

The licensed partner is responsible for: compliance decisions, KYC/KYB approval, customer onboarding, AML monitoring, regulatory reporting, and funds settlement. Futura supports by capturing data securely, but does not make compliance decisions.

No.

Futura never touches or controls funds.

All money movement happens directly between the customer and the licensed financial partner.

Futura operates under the licenses of our third-party partners, such as: banks, remittance companies, ATM processors, payment platforms

Futura supplies the technology and the retail channel.

The partner supplies the licenses and regulatory framework.

Whether you’re a bank, payment processor, fintech, or retail operator, Futura is here to help you expand your services safely, efficiently, and without additional regulatory complexity.

We work alongside licensed financial partners to deliver secure, automated financial services inside high-traffic retail environments—powered by your licenses and our technology.